Judgment Recovery - Judgment Enforcement Judgment Collection

We specialize in the enforcement of unsatisfied judicial judgments. We hunt them down! We garnish their wages (where allowed by law). We attach their bank accounts. We seize their assets. We do whatever is necessary to enforce the judgment that you were duly awarded by the court. We are compensated only when we are successful at collecting against the judgment.

Civil Judgment Enforcement & Collection

Judgment Recovery Associates is a company dedicated to the enforcement of judicial judgments. We purchase your judgment, in its entirety, usually on a ‘future pay’ basis, without application fees or up-front costs of any kind. We advance all the costs and expenses incurred in locating the judgment debtor and enforcing the judgment. We make our money only from the judgment debtor, at no direct cost to you.

The fact is – almost 80% of all judgments are never recovered. Your judgment may have been awarded by the court but enforcement is your responsibility. Judgment Recovery Associates can succeed when you can’t! We have the resources, expertise, and determination to enforce the judgment you worked so hard to get. We will conduct a thorough judgment collection investigation to uncover any assets or sources of income, and take whatever steps are necessary to legally seize them.

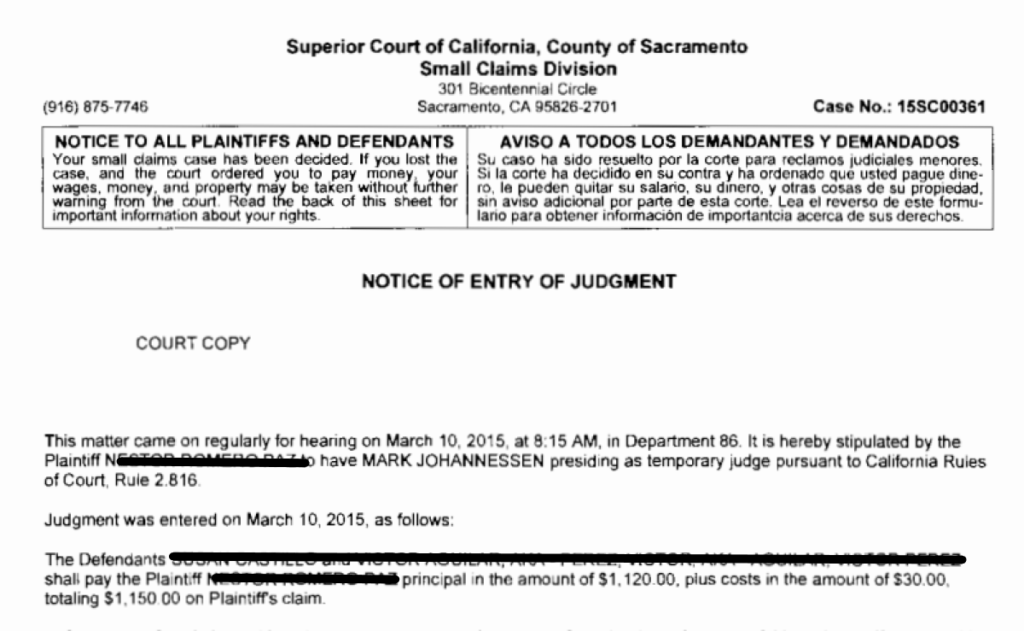

If you have a valid court awarded judgment of $1,000 or more, we will use every method at our disposal to recover the full amount of the unpaid judgment plus any interest that the judgment has accrued since it was issued. We will track the judgment debtor down even if he or she has moved to another state. We have access to both private and public databases that allows us to ‘skip-trace’ the debtor and to locate any assets that he or she may have. As allowed by law, we will garnish wages, attach bank accounts, and seize assets as necessary. If possible, we will try to do so without any notification or confrontation. In short, we will enforce the judgment that was legally and rightfully awarded to you by the courts.

We neither charge an application fee nor require you to cover any upfront expenses. We purchase the judgment from you for a percentage of anything that we are eventually able to recover from the judgment debtor. All expenses and legal costs incurred in the enforcement of your judgment are advanced by us. There is never an up-front charge of any kind. We are currently accepting judgments awarded in all states.

To get the ball rolling, please complete the short Inquiry Form. We will review your case and arrange a telephone consultation with you as quickly as possible. There is absolutely no obligation on your part. Isn’t it time justice was served?

Still have questions? Please Click Here to view the Frequently Asked Questions. Steps start your own judgment recovery business.